Tulips, Di-Worsification, and Managing Risk and Reward

Personal finance, investment philosophies and fun facts - all without the jargon.

Welcome to the sixth edition of the Bodhi Newsletter! In today’s edition, we cover:

- The Dutch Tulip Bubble

- Diversification or Di-worsification?

- Investor Spotlight: Sunil Singhania

Bloom and Bust: The Tale of the Dutch Tulip Bubble

By Soham Dengra

“History doesn't repeat itself, but it often rhymes.”

-Mark Twain

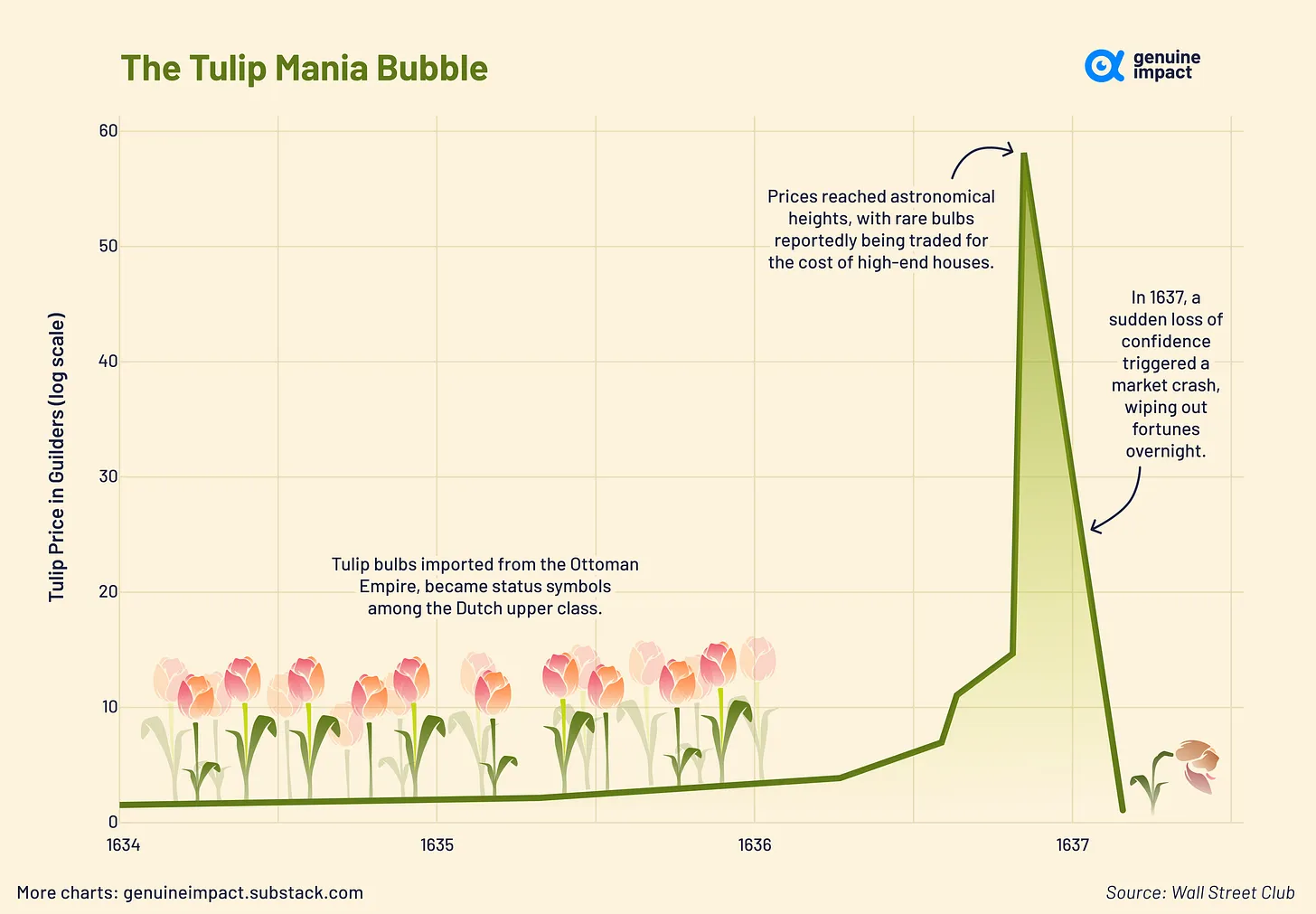

A stock market bubble can be defined as a situation wherein stock prices rise to unreasonably high levels in relation to their underlying fundamental or business value. With Indian stock market indexes NIFTY and SENSEX touching their all-time highs and the broader stock market experiencing one of the biggest bull runs in its history, there has been an increasing amount of chatter around the creation of a “bubble” in the market. However, this is not the first time that such a bubble has been created. Today, we’re going to look at the first recorded case of an asset bubble- The Dutch Tulip Bubble.

What was the Dutch Tulip Bubble?

The Dutch tulip bubble aka the “Tulipmania” began when Ottoman traders introduced this flower to the Dutch during the early 1630s where it caught the eye of the rich, upper-class Dutch population. However, growing tulips was a painstaking process, with the flowers being notoriously fragile and requiring careful cultivation. Soon, the Dutch realised that growing new tulips from existing bulbs was much easier and faster than growing the plant from seeds. This newfound ease of growing the prestigious tulips, combined with the growing prosperity of the Dutch economy which had become a global hub for financial innovation, resulted in a growing demand for tulip bulbs.

Tulips, seen as status symbols and items indicating good taste, were limited only to the affluent class. However, with the introduction of tulip bulbs, Holland’s growing middle class of merchants and bankers soon got attracted to them in their attempts to emulate the wealthy class.

By 1634, the tulip mania had swept throughout Holland with tulip bulb prices increasing to unprecedented levels. Brokerages were set up to trade this prized asset and soon tulip bulbs were being traded for anywhere between $5,000-$150,000, with the rare and highly-valued Semper Augustus tulip bulbs selling for ~ $1 million in today's money. People started buying bulbs on credit (leverage) and this led to the birth of what are today called “margined derivative contracts”. At the height of this frenzy, some bulbs were selling for more than a house on the prime real estate of the Amsterdam Canal.

The tulips which were initially in demand because of their worth as status symbols soon derived much of their excessive value from speculators hoping to buy these bulbs at absurd prices, only to sell them to another person at an even higher, even more absurd price (pretty reminiscent of the NFT boom).

However, one thing which happens to all bubbles is- they pop. So did this one.

By 1637, the bulbs had become so expensive that buyers became scarce. As the demand declined, this bubble popped and tulip prices fell off a cliff. People had initially purchased bulbs on credit, hoping to repay when they sold their bulbs for a profit. However, as the prices kept falling, the holders were forced to sell their bulbs at any price they could get. Soon by 1638, tulip bulb prices were back to normal.

While the Dutch tulip mania may not have left the same impact on the economy as the economic crashes we’ve seen in recent times, it did leave many people with massive debts, ruined Dutch relations built on trust, and made the citizens cautious of speculation in trading.

The Dutch tulip bubble serves as a cautionary tale for investors even today, standing as a reminder that speculative manias can drive asset prices to unsustainable heights, often divorced from their fundamental value. It highlights the dangers of herd mentality and the risks associated with engaging in speculative investments in pursuit of quick gains, reminding us that speculation can never lead to sustainable long-term wealth creation.

Diversification or Di-worsification?

By Neel Issrani

We've all heard the adage, “Never put all your eggs in one basket.” This is the concept of diversification. In the world of investing, diversification is often known as the golden rule- it has been a fundamental strategy that investors swear by.

But why diversify?

At its core, diversification is about risk management. Spreading investments across various assets and sectors minimises the risks associated with market volatility. A well-diversified portfolio tends to have less volatile returns and helps cushion against significant losses, providing a smoother investment ride. This is because not all asset classes or sectors move down simultaneously.

That being said, it's important to remember that no matter how diversified a portfolio is, risk can never be completely eliminated. No amount of diversification can completely eliminate risk. However, diversification in investing is much like seasoning a dish- Just the right amount can enhance the flavour, but too much can ruin what might have been a perfect dish. So diversification does actually have a trade-off which is reducing the overall portfolio's return potential.

Essentially, an investor can accumulate so many investments that rather than diversifying, they end up "di-worsifying" their portfolio. This means the portfolio is actually worse off because the extra investments beyond a certain point offer no further benefits of minimising risk or volatility, rather they are just reducing the return potential of the portfolio. The main problem with over-diversification is that it can lower a portfolio's returns without greatly reducing its risk.

Adding more investments might slightly decrease risk, but it also tends to reduce the returns you might expect. This is because owning additional stocks takes away the potential of big gainers significantly impacting the returns. There comes a point when an investor has so many investments that the risk reduction from each new addition is less significant than the decrease in potential returns.

Another peril of over diversifying is that investing into too many stocks makes it difficult to track them all. This spreads an investor's focus too thin and takes away from their high conviction ideas and forces them to spend time tracking the other holdings.

So how much diversification is too much?

Well, there's no straightforward answer to this. There's no single number that differentiates a well diversified portfolio from an over diversified one. Over-diversification isn't just about the sheer number of investments; it's about diluting a portfolio with lower-conviction investments simply to achieve diversification.

Seasoned investor Peter Lynch captured it perfectly: "Owning stocks is like having children—don’t get involved with more than you can handle.” The most practical way to avoid “di-worsification” is to simply own only those many stocks that can be managed with full focus only on those stocks. This is, of course, true only as long as they are in various sectors and are not very highly correlated. The ideal scenario involves diversifying across different sectors to minimise risk and volatility while ensuring each investment can be actively managed and isn't just included for the sake of diversification.

Sometimes, over diversification can also be hidden in the form of overlaps. For example if you own multiple mutual and index funds that invest in the same companies. Diversification is indeed a double-edged sword. A good investor recognizes when additional investments cease to add value and turn their focus instead to maintaining a portfolio that is as diverse as necessary, but no more.

Investor Spotlight

Sunil Singhania

By Kavya Sharma

Sunil Singhania is a shining example of a man who has demonstrated how strategic acumen and steady wealth creation can be achieved in the dynamic world of Indian investing. With his intelligent aura and the trend of thought as a visionary, Singhania has not only served his best in financial sector for more than three decades but also imparted some invaluable lessons during his course.

Investment Philosophy and Journey

Sunil Singhania’s investment philosophies are centred on his dedication to creating diverse portfolios that strike a balance between growth potential and stability. His method is a careful screening process that spans market capitalizations. Over his investment period he has amassed a portfolio of over 3,000 crore which encompasses both large and small cap companies. In addition to reducing risk, this dual strategy sets up portfolios to take advantage of new possibilities in dynamic market settings.

Singhania began his journey with a strong educational background and a determined will to understand the intricacies of finance, for which he earned his coveted Chartered Financial Analyst (CFA) designation. His strong underlying interest in equites and analytical skills proved to be very strong foundation for his career success. Over 15 years at Reliance Capital, he initially led equity investments with a focus on Indian companies and eventually ascended to the role of Global Head of Equity. Under Mr. Singhania's stewardship, the reliance growth fund achieved a remarkable 100% growth. He founded Abakkus Asset Management Company (AMC) in 2018 where he is committed to high quality investing based on rigorous research and strategic market insights.

Key Principles and Lessons for College Students

- Diversification and Risk Management: According to Singhania, it is important to diversify assets across industries and asset classes. In simpler terms, what this means is that college students should invest in a broad set of companies or mutual funds to hedge against any one company going down or in order to lessen the effect of the performance of any one investment on their portfolio as a whole.

- Long-Term Vision: Like a lot of successful investors, Singhania clearly subscribes to the long-term viewpoint. One of the great things about investing for those in college or even young adults in general is that time is an enormous advantage. By getting an early start, harnessing the powerful tool of compounding becomes possible and college students also prove able to withstand short-term market swings better than most older investors.

- Education: The experience of Singhania underscores the significance of training and concerning oneself with the most recent improvements in the industry. College students' ability to make wise investment decisions can be greatly improved by laying a solid foundation in financial literacy through classes, books, keeping up with the news, and hands-on experience.

Legacy

Beyond his role as a fund manager, Sunil Singhania has made a significant impact on moulding the Indian investing landscape. For investors at every level of their careers, his profound awareness of market dynamics, industry trends, and global economic events offers priceless tools. Singhania's dedication to fostering the next generation of investors is demonstrated by his various interviews imparting his lessons and learnings and his support of ethical investment methods.